What is a Deductible on Pet Insurance?

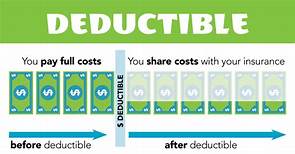

A deductible on pet insurance is a specific amount of money that you have to pay out of pocket before your insurance coverage kicks in. Deductibles can vary greatly from one pet insurance plan to another, and they can also vary depending on the type of coverage you choose. Some plans have a separate deductible for each incident, while others have an annual deductible that applies to all claims. Deductibles are a key factor to consider when choosing a pet insurance plan, as they can have a significant impact on the overall cost of your policy.

How Do Deductibles Work?

When you submit a claim to your pet insurance company, you will first have to pay your deductible. Once you have met your deductible, the insurance company will then start to reimburse you for your eligible expenses, up to the limits of your policy.

For example, let's say you have a pet insurance plan with a $500 deductible. You take your pet to the vet for a routine checkup, and the bill comes to $100. You will have to pay the first $500 of the bill out of pocket, and then the insurance company will reimburse you for the remaining $50.

It's important to choose a deductible that you are comfortable with paying. If you choose a deductible that is too high, you may end up paying more out of pocket for your pet's care than you would if you had chosen a lower deductible. However, if you choose a deductible that is too low, you may end up paying higher premiums for your pet insurance policy.

Types of Deductibles

There are two main types of deductibles on pet insurance plans:

- Per-incident deductibles: A per-incident deductible is a specific amount of money that you have to pay out of pocket for each incident that is covered by your insurance policy. For example, if you have a pet insurance plan with a $500 per-incident deductible, you would have to pay the first $500 of your veterinary expenses for each illness or accident that your pet experiences.

- Annual deductibles: An annual deductible is a specific amount of money that you have to pay out of pocket for all of your pet's covered expenses during a policy year. Once you have met your annual deductible, the insurance company will then start to reimburse you for your eligible expenses, up to the limits of your policy. For example, if you have a pet insurance plan with a $1,000 annual deductible, you would have to pay the first $1,000 of your veterinary expenses for all of your pet's illnesses or accidents during the policy year.

Factors to Consider When Choosing a Deductible

When choosing a deductible for your pet insurance plan, you should consider the following factors:

- Your budget: How much money can you afford to pay out of pocket for your pet's veterinary expenses? If you have a tight budget, you may want to choose a higher deductible. This will lower your monthly premiums, but you will have to pay more out of pocket when you file a claim.

- Your pet's age and health: If your pet is young and healthy, you may be able to choose a higher deductible. However, if your pet is older or has a chronic health condition, you may want to choose a lower deductible to ensure that you have adequate coverage for your pet's veterinary expenses.

- The type of coverage you want: Some pet insurance plans offer more comprehensive coverage than others. If you want a plan that covers a wide range of veterinary expenses, you may want to choose a lower deductible. However, if you are only interested in covering basic veterinary expenses, you may be able to choose a higher deductible.

Conclusion

The deductible is an important factor to consider when choosing a pet insurance plan. By understanding how deductibles work and the different types of deductibles available, you can choose a plan that meets your specific needs and budget.

Declaration: All article resources on this website, unless otherwise specified or labeled, are collected from online resources. If the content on this website infringes on the legitimate rights and interests of the original author, you can contact this website to delete it.