What is the Annual Deductible for Pet Insurance?

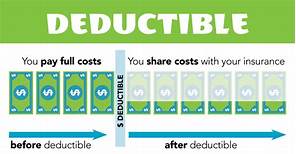

When it comes to pet insurance, the annual deductible is an important factor to consider. It's the amount you'll have to pay out of pocket before your insurance coverage kicks in. Deductibles can vary widely between different pet insurance plans, so it's essential to understand how they work and choose a plan that's right for you and your pet.

How Do Annual Deductibles Work?

When you purchase pet insurance, you'll select an annual deductible amount. This amount will be set for each policy year, and you'll be responsible for paying all veterinary expenses up to that amount. Once you've met your deductible, your insurance coverage will kick in, and the insurance company will reimburse you for a percentage of your eligible expenses, typically 70-90%.

For example, if you have a $500 annual deductible and your pet gets sick and needs surgery that costs $1,000, you'll be responsible for paying the first $500. The insurance company will then reimburse you for the remaining $500.

What are the Different Types of Annual Deductibles?

There are two primary types of annual deductibles for pet insurance:

- Per-incident deductible: This type of deductible applies to each individual incident or illness. For example, if your pet gets sick and needs two surgeries in the same year, you'll have to pay the deductible for both surgeries.

- Aggregate deductible: This type of deductible applies to all covered expenses for the entire policy year. Once you've met your aggregate deductible, your insurance coverage will kick in for the remaining expenses, regardless of how many times your pet gets sick or injured.

Which Type of Annual Deductible is Right for Me?

The type of annual deductible that's right for you will depend on your budget and your pet's health needs. If you have a healthy pet and don't expect to have many veterinary expenses, you may want to choose a higher deductible plan. This will lower your monthly premiums, but you'll have to pay more out of pocket if your pet does get sick or injured.

If you have a pet with a pre-existing condition or is more prone to illness or injury, you may want to choose a lower deductible plan. This will give you more peace of mind knowing that you won't have to pay large out-of-pocket expenses if your pet needs medical care.

Compare Pet Insurance Plans

When you're shopping for pet insurance, be sure to compare the different plans available and their annual deductibles. You should also consider the other policy features, such as the coverage limits, the reimbursement percentage, and the waiting periods. By comparing plans carefully, you can find the best pet insurance policy for your needs and budget.

Declaration: All article resources on this website, unless otherwise specified or labeled, are collected from online resources. If the content on this website infringes on the legitimate rights and interests of the original author, you can contact this website to delete it.