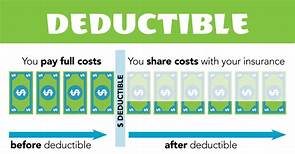

What is a deductible in pet insurance?

A deductible is a specific amount of money that you must pay out-of-pocket before your pet insurance policy begins to cover your pet's medical expenses. Deductibles can vary widely from policy to policy, ranging from $100 to $1,000 or more. The size of your deductible will impact your monthly premiums, with higher deductibles typically resulting in lower premiums and vice versa.

How does a deductible work?

When you make a claim under your pet insurance policy, you will be responsible for paying the deductible amount before the insurance company will start to reimburse you for eligible expenses. For example, if your pet's medical bill is $1,000 and you have a $500 deductible, you would need to pay the first $500 out-of-pocket. The insurance company would then reimburse you for the remaining $500.

Types of deductibles

There are two main types of deductibles in pet insurance: annual deductibles and per-incident deductibles.

Annual deductibles: With an annual deductible, you only need to pay the deductible once per policy year, regardless of how many claims you make. This type of deductible is best for pet owners who expect their pet to have ongoing medical expenses, such as those with a chronic condition.

Per-incident deductibles: With a per-incident deductible, you must pay the deductible each time you make a claim. This type of deductible is best for pet owners who expect their pet to have occasional, unexpected medical expenses, such as those resulting from an accident or illness.

Choosing the right deductible

The best deductible for you will depend on your individual needs and budget. Consider the following factors when choosing a deductible:

- Your pet's age and health: Older pets and pets with chronic conditions are more likely to have medical expenses, so you may want to choose a lower deductible to avoid paying a lot out-of-pocket.

- Your budget: If you have a tight budget, you may want to choose a higher deductible to lower your monthly premiums. However, keep in mind that you will be responsible for paying the deductible each time you make a claim.

- Your pet's expected medical expenses: If you expect your pet to have ongoing or frequent medical expenses, you may want to choose a lower deductible to avoid paying a lot out-of-pocket. If you expect your pet to have occasional, unexpected medical expenses, you may be able to save money by choosing a higher deductible.

Conclusion

Choosing the right deductible for your pet insurance policy is an important decision. By considering the factors discussed above, you can choose a deductible that meets your needs and budget.

Declaration: All article resources on this website, unless otherwise specified or labeled, are collected from online resources. If the content on this website infringes on the legitimate rights and interests of the original author, you can contact this website to delete it.